A good choice is the Brompton Flaherty and Crumrine Investment Grade Preferred ETF

A good choice is the Brompton Flaherty and Crumrine Investment Grade Preferred ETF

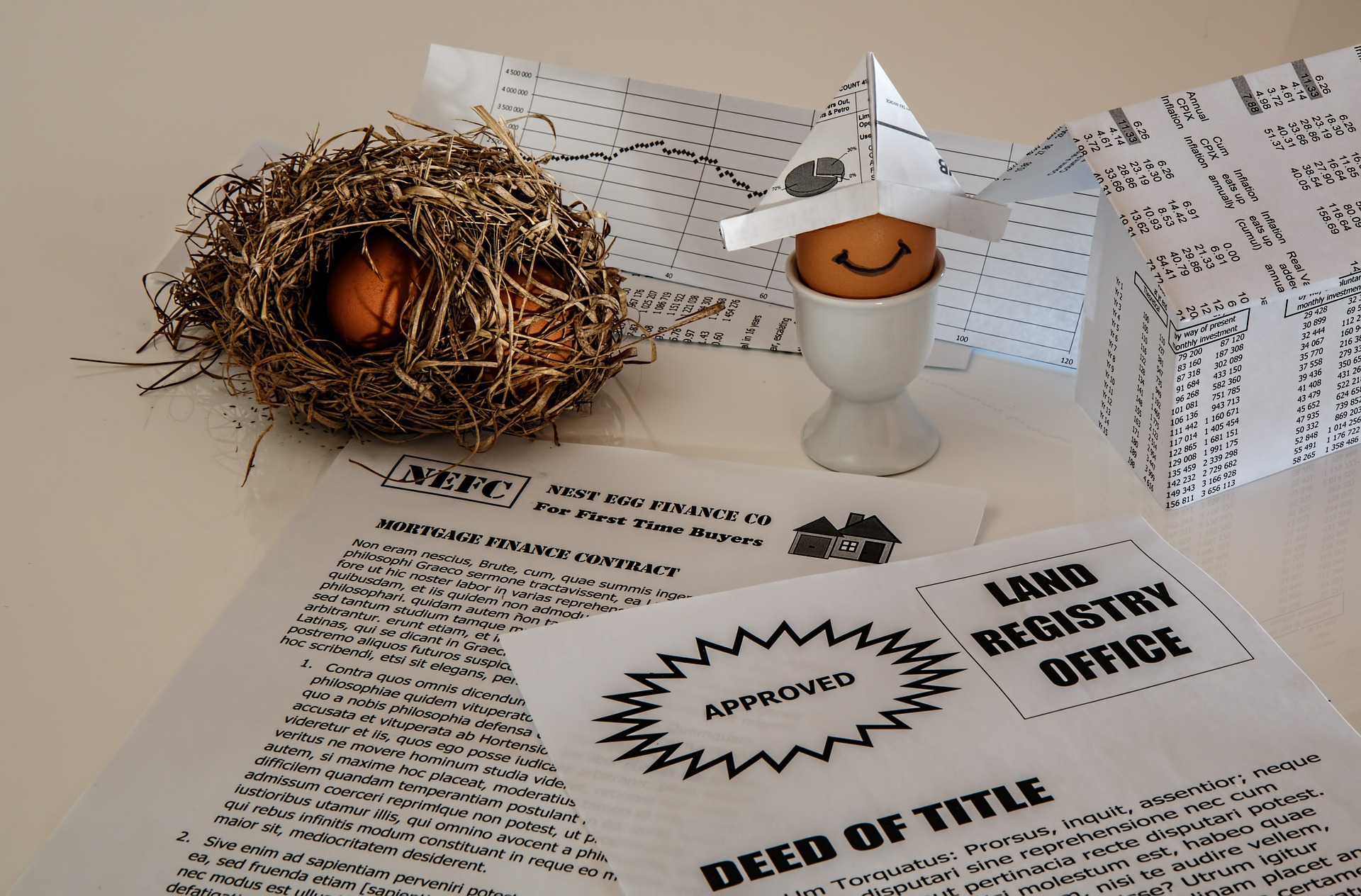

My daughter is saving for a future home purchase and also wants to build an emergency fund. What’s her best approach?

Identify today’s secular trends and invest in companies that will benefit.

Which discount brokers do you suggest?

Stocks that will perform well throughout the pandemic and beyond.

What would it mean for the markets?

Buying stocks? Look out for these red flags.

The portfolio was down a little over 4%. Time for some changes.

The stock market has been persistently optimistic in recent weeks.

The stock market is beaten, there’s turmoil in bonds, where do investors turn?

What will the world look like when the crisis ends?

Our responsibility at BuildingWealth is to provide guidance on the financial impact of this world crisis.

Why is the price of gold going down?

How low will the markets go? How long will this last?

The longest bull market in history is over.

The situation is more acute by the day.

It’s crisis time again!

Here’s what to do.

In the latest edition of our newsletter, The Income Investor, I offer my insights on how to grow this retirement must-have.

Most income stocks thrive when interest rates go down.

2020 marks the start of the 25th year for this website and our IWB newsletter.

What does 2020 hold for your finances?

Spend some time during the holidays catching up on your donations.

It comes with a big price tag!

The focus is cash flow and safety. Capital gains like these are a nice bonus.

The markets posted good numbers in 2019 but many of our IWB picks did even better.

If one-stop shopping is your preference, here is an ETF to consider.

Many people have no idea how to manage their money for retirement.

My partner is 67 with no RRSP. He works and he can save $2000 every month. Is it smarter to put that extra money toward the mortgage or to start a new RRSP?

What do you think about buying and holding gold in either our TFSAs or RRIFs?

I have been using financial advisors for years but would now prefer to manage my own funds. How do I find a good broker?

Where can we hold cash to at least earn something while we wait for more buying opportunities?

Total gain over seven years is 375.6%.

About $15 trillion worth of bonds worldwide now carry negative yields

The easiest way to add bonds to your portfolio is to buy ETFs that invest in them.

There was no need to cut rates at this point.

The current U.S. bull market is the longest running bull since the Great Depression.

Investors want securities that are environmentally friendly and potentially profitable.

If you want to invest in IPOs, I have some tips that may help.

Markets can change course quickly and unexpectedly.

Here’s what to do with your refund.

Changes designed to make it easier for millennial home-buyers in pricey markets like Toronto and Vancouver.

What our our leaders do has a direct effect on our personal well-being and on the direction of many stocks.

Momentum is building and investors are increasingly looking to get in on the action.

More market swings are just over the horizon. How do you protect your assets?

54% of Canadians have money invested in an RRSP, but good public education about retirement planning is still hard to find.

The portfolio has two objectives: preserve capital and earn a higher return than a GIC.

The first rule of retirement planning – make a contribution!

How much of your money is invested in stocks, bonds, and cash?

Take a closer look at what’s hanging on your walls or go rummaging through the attic – a small fortune may be hiding in your home.