Walmart, Fortis, and Royal Bank

Stocks to own in 2026

Walmart, Fortis, and Royal Bank

Here’s a look at five of our big winners from last year.

Investors often avoid holding cash in favor of investments with higher returns.

There are many places to park cash, but none is perfect.

We asked our followers on social media.

Many businesses are almost paralyzed.

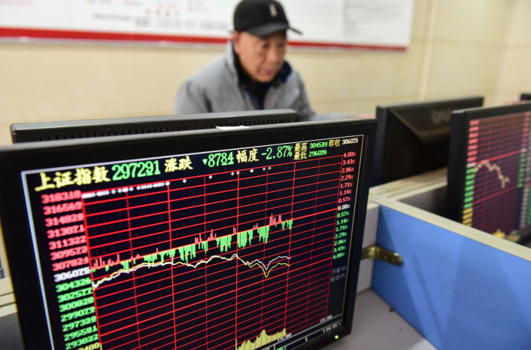

The trade war is on.

The best income stocks should offer a triple advantage.

Trump is not known as a great wit.

The winners (and losers) of 2024!

The next four years are going to be difficult for investors.

Investors are buying stocks that they think will be winners.

Two CanTech recommendations that are posting good gains this year.

Streaming, theme parks, cruise lines, and hit movies!

These securities will recover as interest rates stabilize.

The best (and the worst) of 2023!

The price to book value ratio can be very difficult to interpret and indeed at times provides little to no guidance.

Investment in Snowflake raises eyebrows.

There’s been a turnaround in the performance of utilities.

No one is quite sure where the stock markets are going next.

Only $100,000 per eligible account.

Is it a good time to buy stocks?

Is it better to hold individual stocks like Scotiabank, Rogers, Quebecor, etc., or to hold a dividend fund like HAL?

I searched for more ETFs that may have been overlooked and came up with some interesting ideas.

Share prices are becoming attractive for top quality companies and beaten down tech leaders.

By Gordon Pape, Editor and Publisher This is a big year for us. It’s the 25th anniversary of our first full year of publication, and we’ve designed a special logo to mark the occasion. When we first started out a quarter-century ago, we were venturing into new territory. To the best of my knowledge, no […]

What’s an investor to do?

The target rate of return was originally set at 8 per cent annually.

What do consumers do when costs rise? They look for cheaper alternatives. Hello, big box stores.

Suitable for investors looking for dependable cash flow and can live with the ups and downs of the share price.

By Shawn Allen, Contributing Editor How should investors position themselves as automation and robotics threaten many jobs, particularly in manufacturing? Employees who are not investors may have few options. But for investors, the logical response is to invest in the companies that are benefiting from automation and robotics. Automation has been eliminating jobs since at […]

Are we about to see another dot.com crash?

Reports of TC Energy’s death are greatly exaggerated.

Rock-bottom interest rates lead to people relying on stocks for income.

A good choice is the Brompton Flaherty and Crumrine Investment Grade Preferred ETF

Identify today’s secular trends and invest in companies that will benefit.

Stocks that will perform well throughout the pandemic and beyond.

What would it mean for the markets?

Buying stocks? Look out for these red flags.

The portfolio was down a little over 4%. Time for some changes.

The stock market has been persistently optimistic in recent weeks.

The stock market is beaten, there’s turmoil in bonds, where do investors turn?

What will the world look like when the crisis ends?

Our responsibility at BuildingWealth is to provide guidance on the financial impact of this world crisis.

How low will the markets go? How long will this last?

The longest bull market in history is over.

The situation is more acute by the day.

It’s crisis time again!

Here’s what to do.

In the latest edition of our newsletter, The Income Investor, I offer my insights on how to grow this retirement must-have.